The Relationship Between Customer Experience Management and Sales

What is the relationship between CEM and sales? A lot has been said about loyalty but what about acquisition? Using Beyond Philosophy’s emotion database, I took a subset of surveys with per person sales data (equivalent to £17million over 7 samples) and correlated spend to measures of attitude and touchpoint quality. The point was to answer the question, on acquisition (sales) what correlates to spend? The results are shown below.

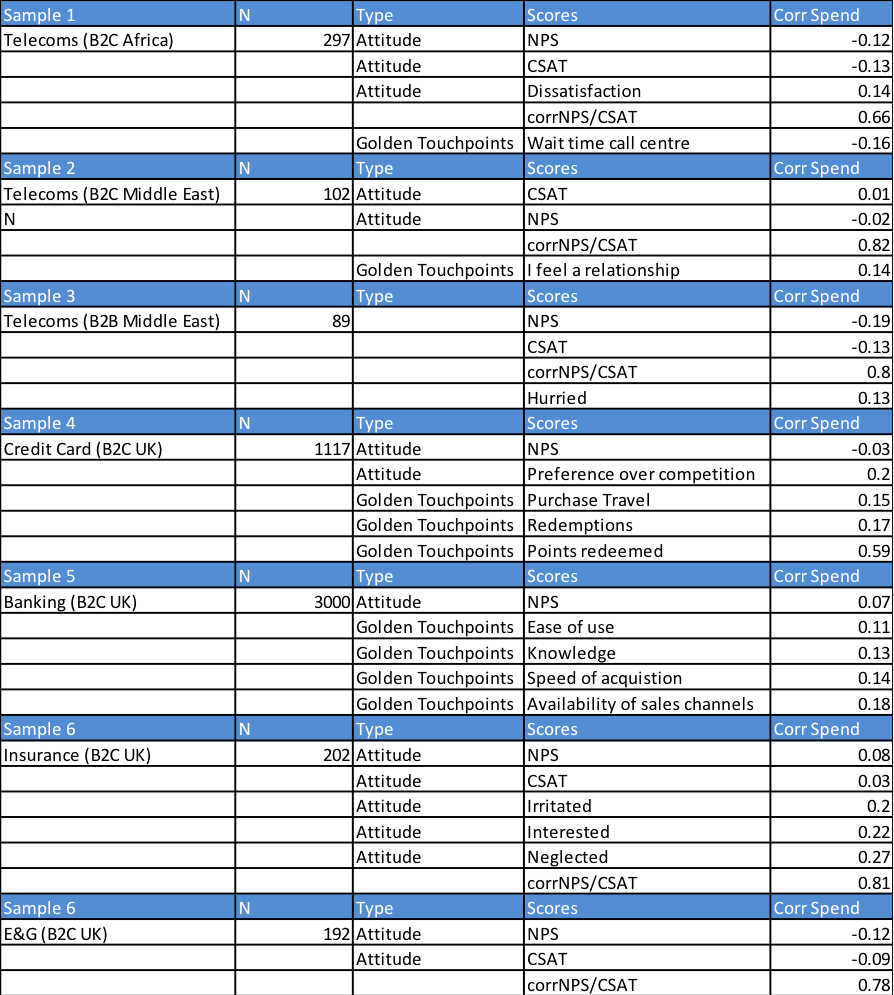

Correlation between Scores and Spend

In total an average of 40 touchpoints, 20 emotions and 6 KPIs were tested for correlation to Spend. The results shown are (excluding NPS®/CSAT) the most positive ones. In most cases the results were insignificant and marginally negative i.e., a perverse result that the more positive the experience is felt to be the lower the spend or the lack of impact on spend.

In summary the other key results are:

- CSAT and NPS® are very similar

- CSAT and NPS® have no or a negative relationship to immediate spend

- Emotion plays a limited role in immediate spend

- There are many perverse relationships (very mild negatives)

- Touchpoints directly related to spend behaviour are better correlates to spend

- Each scenario has its own specific drivers – you should not generalise

- Ease did not appear to hold much of a relationship to spend

- Dissatisfaction is mildly related to spend in some cases (i.e. more dissatisfied, less spent)

- Touchpoint quality even when it holds a correlate to spend does not seem to lead to a change in the attitudinal relationship to spend i.e., a lot of touchpoint effects are ‘under the hood’ – unnoticed when related to attitude but noticed when related to spend: a critical finding.

- Behaviour is acquisitive so tends to relate directly to purchase goals

- Many relationships are very mild in effect i.e., spend is often habitual

Management Implications

- Spend is driven by a huge range of effects, I may go to a supermarket and love the place but spend less money at that moment in time than someone else who dislikes it or is neutral to it spends more. Momentary analysis will lead to perverse effects

- Homeostatic regulation dominates attitudinal/ emotional effects. What this means is, you don’t feel the same level of emotion the 10th time you visit say a store when compared to the first. Hence, scores are likely to be curvilinear – customers are liable to say ‘yep it was good’ 8 out of 10 even with an excellent experience, hence looking for emotional / attitudinal linear relationships to spend is unlikely to succeed. Negative dissatisfaction by consequence, because customers (and non-customers) are more sensitive to this is more likely to be a destroyer of spend (its interesting that this Prospect theory effect is not actively and separately measured, something I have mentioned before).

- It is important to find what I call the ‘golden touchpoints’; these are touchpoints that could be physical or psychological and are more likely than attitude to hold a relationship directly to spend.

- NPS®/CSAT in the acquisition (sales) paradigm are virtually the same. This does not of course consider the social advantages or any representation to loyalty, but in a pure acquisition sense choose one or the other but not both.

- Each experience has proprietary effects, diagnose to the situation.

- Design CEM metrics to the touchpoints do not use proxy attitudinal measures.

- Of course this analysis is based on an ‘as is’ state. Analysis should not prevent consideration of creating a more positive ‘to be’ experience. In other words, don’t depend on crafting a new to be experience just based on the boring value correlates of a boring experience. Quants can give some principles (especially when dealing with consumer psychology rather than big data) but it is not the answer.

|

|

Steven Walden is VP Consulting and Thought-Leadership for Beyond Philosophy. Steven has 17 years Strategy Consultancy experience directing and designing strategies for major B2C & B2B firms. At Beyond Philosophy, the Global Customer Experience Consultancy, he is a Thought Leader and Innovator, directing engagements to assist leading firms to transform through Customer Experience. A world-leader in emotional experience his skills lie in innovation, thought-leadership, strategy consultancy and Qual/ Quant research. He is a regular speaker at conferences, blog writer, CE Trainer and international author.Follow Steven Walden on Twitter: @Steven Walden |