Future Desires

Almost all companies have insight departments that statistically model the drivers and destroyers of consumer behaviour. Yet this predictive modelling is flawed as it assumes that what customers react to today in terms of their drivers to buy are the same as what those customer’s actually desire.

To make this real consider the following:

‘Imagine a Ford car showroom in the 1920s. All cars would have been available in one colour only – black – and in one product type – the Model T. Any decision to buy would have been made on price. However, if you ask customers directly what they would like, they would have said alternative colours and product types. There is a difference between what is offered and what could drive value.’

My hypothesis therefore is a simple one:

H1: Any model that extrapolates the drivers of customer wants based on their current ratings of an experience does not equate exactly to what customers ‘truly’ want.

Fortunately, here at Beyond Philosophy we have tested this out. Using client samples, we interviewed consumers of products and services across a range of industries. Each sample was asked to complete a scale survey (enabling SEM/PLS based modelling) as well as a Max Diff survey (enabling an assessment of levels of desire towards attributes of an experience). In each case, customers were asked to provide ratings over 40 attributes of an experience.

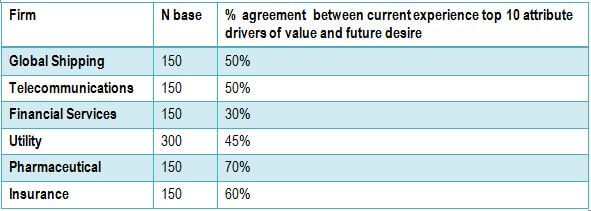

Table 1 summarises the results. In this case, the assessment compares the degree to which the top 10 drivers of value (based on current experience) are also the top 10 stated drivers of what customers would like (i.e., desire).

Table 1: Comparison between current driver assessment and future desire

Over the above 1,050 interviews it has been found that if you were to only focus on those top 10 attributes of an experience that in SEM/PLS based modelling are seen to drive most value, you would only cover 5 out of the top 10 attributes customers most desire!

This means that modelled drivers of value based on past experience only equate to half the value customers actually most desire. This confirms that you must consider not only current experience drivers but also future desires when designing an experience.

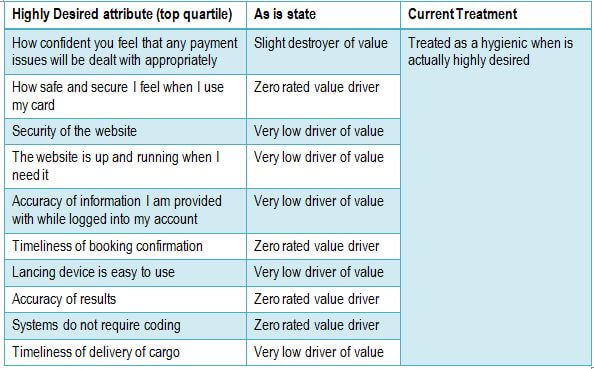

When we look further at the data we can also see what type of attributes are being desired by customers but not seen to drive value. These are shown in Table 2:

Table 2: The types of attributes customers desire but don’t drive current value

The treatment of these items is easy to understand. They are the result of a statistical mirage, where non-variance is taken to mean not important. Let me give you an example by analogy taken from the paper ‘The Top 10 things wrong with Quantitative Research’.

If you go to a cafe at lunchtime to buy a sandwich, one of the main drivers to purchase will be ‘sandwich quality’ which you score at say 8 out of 10. Now let’s say you go every day for a month and every day you score 8 out of 10 (you like the cheese and pickle sandwich). Let’s imagine that you are also asked about satisfaction and that tends to vary a little with superfluous short-term effects, such as one day they had some boxes in the way of the entrance. This doesn’t change the fact that when you spend money it’s related to the quality of sandwich.

Unfortunately, because the quality scores are stable over the long-term and there is no or very limited variance, the importance of ‘sandwich quality’ is completely missed, or worse it is considered hygienic when in fact it is critical. You can only see its impact if it changes, and because it hasn’t changed you cannot see its impact. Therefore it does not become a focus for intervention and ideation. Worse because short-term effects on Customer Satisfaction are deemed more important, money is spent on keeping the aisles clear rather than trying to create new sandwich ranges. This even though the relationship between Customer Satisfaction and spend is not established or poorly established.

Hence, these items, so critical to value, are being treated as hygienic when in fact they can and should be the focus for value creation. Why? Because in the mind of the consumer they are critical to what they want; after all this is what they have stated, never mind our modelled drivers of value.

It may well be the fact that some are difficult to alter, but at least you should ask the question in your experience design.

At this stage you may also be noticing the opposite effect. That 5 out of the top 10 drivers of experience are noticed in the modelling but not in the expressed desires of customers. This is equally valid and something we call a ‘subconscious’ value effect i.e., like advertising, it is an unexpressed driver of value.

Value can now be conceived as not just the result of current experience but also future desire (a combination of what is experienced and what future desires consumers hold).

Finally, I end with a quote that encapsulates how as human beings our mindsets are not just reactive to the current or past but are always looking to what might be; hence we must always take future desires into consideration:

‘To be self aware means you can engage in mental Time Travel. You can think of yourself in relation to things that happened in the past, present and may even happen in the future’ Professor Gordon Gallup, BBC Horizon – The Secret you

Management Implications

1. Attributes of your experience that are most desired, even though they do not currently drive any value, must be considered for their potential to drive value.

2. Managers must drop the concept of hygienic.

3. Insights must combine SEM/PLS modelling of past/current experience effects with those that model ‘most desired’ i.e., Max Diff and conjoint approaches together! This is also beneficial as it highlights areas of desire that are currently non-variant e.g., ‘I’ desire a low interest rate, but the modelling does not see interest rates as important to value as they are unchanged.

4. Of course, it should always be remembered that companies can create experiences previously not considered important or even conceived by consumers – look at Apple!

5. Read the Top 10 things wrong with Quantitative Research.

|

Steven Walden is VP Consulting and Thought-Leadership for Beyond Philosophy. Steven has 17 years Strategy Consultancy experience directing and designing strategies for major B2C & B2B firms. At Beyond Philosophy, the Global Customer Experience Consultancy, he is a Thought Leader and Innovator, directing engagements to assist leading firms to transform through Customer Experience. A world-leader in emotional experience his skills lie in innovation, thought-leadership, strategy consultancy and Qual/ Quant research. He is a regular speaker at conferences, blog writer, CE Trainer and international author. |