With all the talk around customer loyalty over the years, I have been asked several times recently for whatever reason, what customer loyalty is and how does one know when they have it. The answer is simple. You don’t have loyalty unless the customer is “happy” to make a sacrifice to do business with you in the face of “better” options in the customer’s own mind. The more sacrifice the customer happily makes, the greater the loyalty. Tenure is not necessarily loyalty. Often it is not. Tenure of course can be the result of loyalty but it is often the result of having too high a cost of switching to a competitor or contractual lock-in.

So, is the difference between tenure and loyalty a conceptual one only? Aren’t most businesses really interested in customer longevity as that implies repeat purchases and hence increased revenue or lifetime value? Perhaps this would be true if the competitive landscape were constant. In such a situation a customer’s choice at one point would be their choice at any point. However, in the real world, customers are presented with choice. Businesses that pay attention to simple tenure to the detriment of sacrificial loyalty will underestimate the risk they face when their competitive position or landscape changes. Customers churn when they perceive a better deal (i.e., some better combination of price, speed, and quality) elsewhere where the cost of switching is not too high.

One solution is to create a business model that increases the cost of switching. This method forces tenure upon the customer. This is a lock-in strategy, not an opt-in one. Again, this is great until there is a competitive shift in the market. As soon as customers perceive a real alternative opportunity, they bolt. Businesses that pay attention to loyalty minimise the risk of churn during downturns as they will have invested to make customers willing to ride out the storm with them.

Any business can establish competitive advantage by being better, faster or cheaper. Successful businesses generally get that way by offering any two at a time. The third benefit is the premium the customer pays:

- Price premium – better and faster will not be cheap.

- Quality premium – faster and cheap will not be better

- Speed premium – cheaper and better will not be faster

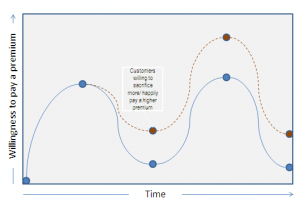

One of the biggest benefits of customer loyalty is increase in lifetime value at the bottom of your business cycle when things are not the healthiest. In the diagram, the dotted line represents the benefit of focusing on sacrificial loyalty. In the lean times, the business effectively cashes in on the investment it has made in its rational and emotional customer experience.

One of the biggest benefits of customer loyalty is increase in lifetime value at the bottom of your business cycle when things are not the healthiest. In the diagram, the dotted line represents the benefit of focusing on sacrificial loyalty. In the lean times, the business effectively cashes in on the investment it has made in its rational and emotional customer experience.

It is nice to believe that a long average tenure is proof of customers’ loyalty. Assuming this is the case, sets the business up for an unexpected downfall. Ask the phone company as their market was deregulated. Ask the pharmaceutical company when their blockbuster drug reaches the end of its patent protection. Ask the high tech company whose advances have finally been caught up by the competition.

Ask yourself, “What are we doing now that would motivate customers to happily sacrifice in order to do business with us when we are not on our current high”. Customer experience increases customer loyalty by getting customers to sacrifice/ to pay a premium. Thus, one of the main benefits of customer experience is revenue protection during the downturn.

| Qaalfa Dibeehi is Chief Operating and Consulting Officer at of Beyond Philosophy one of the world’s first organizations devoted to customer experience. Qaalfa is an international co-author of Customer Experience: Future Trends and Insights. Beyond Philosophy provide consulting, specialised research & training from offices in Atlanta, Georgia and London, England. Follow Qaalfa Dibeehi on Twitter @Qaalfa_BeyondP |